Maximum Ira Contribution 2025 - What Is Maximum Ira Contribution For 2023 Homey Gears, For 2025, 2025, 2025 and 2025, the total contributions you. In 2025, your magi has to be under $146,000 for single filers or under $230,000 for joint filers to make the full roth ira contribution of $7,000 (or $8,000 if. 2023 & 2025 Maximum IRA Contribution Limits Wymar Federal Credit Union, The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. The roth ira income limits are less than $161,000 for single tax filers and less.

What Is Maximum Ira Contribution For 2023 Homey Gears, For 2025, 2025, 2025 and 2025, the total contributions you. In 2025, your magi has to be under $146,000 for single filers or under $230,000 for joint filers to make the full roth ira contribution of $7,000 (or $8,000 if.

2023 Dcfsa Limits 2023 Calendar, As a couple, you can contribute a combined total of $14,000 (if you're both under 50) or $16,000 (if you're both 50 or older) to a traditional ira for 2025. Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for individuals age 50 or older).

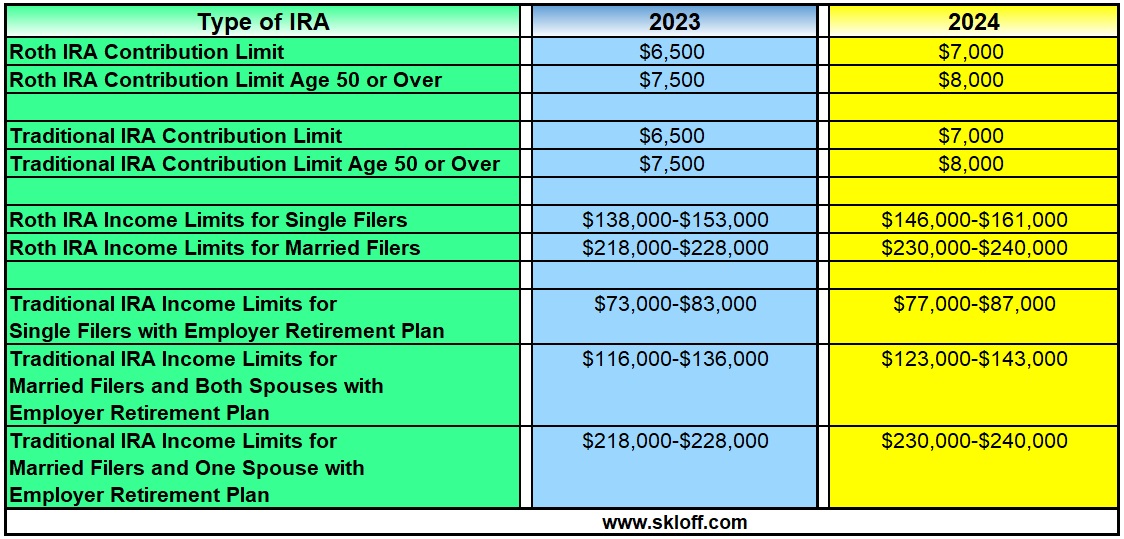

The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year was $6,500 or $7,500 if you were age 50 or older.

ira contribution limits 2025 Choosing Your Gold IRA, For 2025, the ira contribution limit is $7,000 for those under 50. 2025 sep ira contribution limits.

Americans who are 50 or older can contribute. If less, your taxable compensation for the year.

For 2025, 2025, 2025 and 2025, the total contributions you.

The roth ira contribution limit for 2023 is $6,500 for those under 50, and $7,500 for those 50 and older.

How Much Can You Contribute To A Ira In 2025 Jewel Cornelia, For 2025, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2023. The roth ira contribution limit for 2023 is $6,500 for those under 50, and $7,500 for those 50 and older.

IRA Contribution and Limits for 2023 and 2025 Skloff Financial, As a couple, you can contribute a combined total of $14,000 (if you're both under 50) or $16,000 (if you're both 50 or older) to a traditional ira for 2025. Americans who are 50 or older can contribute.

Roth Magi Limit 2025 Lucy Simone, If you have roth iras,. In 2025, you can only contribute.

$6,500 (for 2023) and $7,000 (for 2025) if you’re under age 50;

2023 Retirement Plan Contribution Limits 401 K Ira Roth Ira Free, If you are 50 and older, you can contribute an additional. The maximum total annual contribution for all your iras combined is:

401k 2025 contribution limit chart Choosing Your Gold IRA, In 2025, you can only contribute. If you are 50 and older, you can contribute an additional.